Selling a portion of your land while still holding a mortgage can seem like a complicated process, but it’s entirely possible with the right approach. If you’re asking, “Can I sell part of my land if I have a mortgage in Crestview, FL?” the answer depends on factors like lender approval and property boundaries. Crestview’s real estate market is currently a seller’s market, with a median home price of $312,332—making it an ideal time to consider selling. However, working through mortgage holder requirements and understanding the market is crucial for success. Renowned real estate investors and land buyers for cash, Steve Daria and Joleigh specialize in simplifying transactions like these, ensuring you get the best deal possible. Whether you’re looking to free up cash or reduce your land size, they can guide you every step of the way. Don’t let the complexities overwhelm you—book a free discussion with Steve and Joleigh today to explore your options and learn how to maximize your property’s value. Remember, answering “Can I sell part of my land if I have a mortgage in Crestview, FL?” starts with expert advice and personalized solutions.

Key Points

- Lender Approval is Crucial: Before selling any part of your land, you’ll need permission from your mortgage lender. They hold a lien on the property and must approve any changes to ensure it doesn’t affect their financial interest.

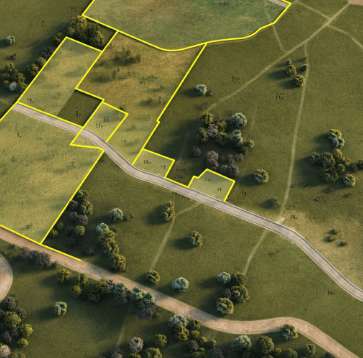

- Clearly Define Property Boundaries: If you plan to sell a portion of your land, it’s essential to have the property boundaries surveyed and properly defined. This step ensures a smooth sale and avoids legal or zoning complications.

- Understand the Market Conditions: Crestview is currently a seller’s market, with a median home price of $312,332. Strong demand means it’s a good time to consider selling part of your land.

- Selling Can Bring Financial Benefits: Selling a portion of your land can help you reduce debt or free up cash for other investments. It’s a practical solution for those who want to use their property better without selling it all.

- Seek Expert Advice: Working with professionals like Steve Daria and Joleigh, renowned real estate investors and land buyers for cash, can simplify the process. They navigate lender requirements with expertise, ensuring you secure the best deal for your property.

What does it mean to sell part of your land while having a mortgage?

Selling part of your land while still having a mortgage means splitting your property and transferring ownership of a specific section to another person, even though your lender has a claim on the entire property.

This process starts with seeking approval from your mortgage lender, as they hold a lien over your land and need to ensure that selling a part won’t reduce the value of their security.

Property division involves a land survey to clearly mark and legally define the boundaries of the sold portion.

It’s also important to check local zoning laws to ensure the part you plan to sell can legally be used or developed by the buyer.

Once the sale is approved, the proceeds are often used to reduce the existing mortgage or pay off part of it, depending on the agreement with your lender.

If you’re wondering, “Can I sell part of my land if I have a mortgage?” Yes, it’s possible, but it requires thorough planning and clear communication with your lender.

This method allows for freeing up cash or downsizing your property while holding some of it.

Working with experts or real estate professionals can help make the process easier and avoid complications.

Get Started: Get Your Cash Offer Below…

We are direct land buyers. There are no commissions or fees and no obligation whatsoever. Start below by sharing where your property is and where we can send your offer…

Can I sell part of my land if I have a mortgage in Crestview, Florida?

Yes, you can sell part of your land even if you have a mortgage in Crestview, FL, but the process requires careful steps and approvals.

To start, you’ll need to get permission from your mortgage lender because they hold a financial claim (or lien) on your entire property.

They will want to ensure that splitting and selling a section doesn’t affect the value of the remaining portion they hold as collateral.

Next, you’ll need to have the land professionally surveyed to clearly define the boundaries of the part you want to sell.

This ensures the sale is legally accurate and avoids disputes later.

Local zoning laws and regulations also need to be checked, as these determine how the land can be used or divided.

Selling part of your land can bring benefits like freeing up cash for other needs or reducing your mortgage balance, depending on how the sale proceeds are handled.

However, you’ll need to communicate with your lender about how the sale might impact your loan terms.

If you’re still wondering, “Can I sell part of my land if I have a mortgage in Crestview, FL?” the answer is yes, with proper guidance and planning.

Working with professionals such as real estate experts and legal advisors can make the process much smoother and avoid unnecessary delays.

How do I determine if selling part of my land is a good idea?

- Review Your Financial Situation: Ask yourself if selling part of your land will help with any financial goals. Whether it’s paying off debt, lowering your mortgage, or funding a new project, the financial benefits could make the sale worthwhile.

- Examine the Real Estate Market: Check Crestview’s current property values and demand. If the market is strong, selling now might bring in a better price for your land.

- Think About Your Future Plans: Consider how selling part of the land fits your long-term goals. Whether you want to downsize, start a new venture, or keep part of the land for family use, ensure the sale aligns with your vision.

- Understand Legal Requirements: Research local zoning and legal rules to avoid issues. Make sure future buyers can use the part you plan to sell as intended, and consult a professional if needed.

- Evaluate the Effect on Property Value: Think about how selling a portion of your land could impact the value of what’s left. While it may bring short-term benefits, weighing this against any potential decrease in overall property value is good.

Will selling part of my land affect the rest of my mortgage?

Selling part of your land can impact your mortgage, so it’s important to understand how the process works.

Since the lender holds a claim on your entire property, you’ll need their approval before selling any portion.

They will want to ensure that the sale does not reduce the value of their remaining security, which is the part of the land you keep.

Depending on the lender’s assessment, they may adjust your loan terms, such as requiring a partial mortgage repayment from the sale proceeds.

Additionally, you might face costs like legal fees or appraisal charges during the process.

Selling part of your land could also affect your monthly mortgage payments if the terms of your loan are revised.

Figuring out these details with your lender beforehand can help you avoid surprises.

If you’ve been asking, “Can I sell part of my land if I have a mortgage in Crestview, FL?” the answer is yes, but it’s essential to follow the right steps and consider the financial implications.

Seeking guidance from your lender and a trusted real estate professional can provide the clarity and confidence you need to take the next step.

What factors should I consider when pricing the part of land I want to sell?

- Market Value: Explore the local real estate market to understand the selling prices of similar plots in your area. This will give you a clear idea of how much buyers are willing to pay.

- Location: The location of your land plays a big role in determining its price. Land near schools, shopping centers, or main roads tends to sell for more because of its convenience.

- Size and Shape: The value of land can be influenced by its size and shape. Larger plots or those with a usable layout are usually worth more than smaller or unevenly shaped pieces.

- Zoning Regulations: Review local zoning regulations to understand the permitted uses for the property. If it can be used for businesses, homes, or other valuable purposes, it may attract higher offers.

- Potential for Development: Land with good potential for building homes or businesses is often priced higher. If utilities and infrastructure like water, sewer, or electricity are already available, this can increase the value significantly.

How can I get started with selling a portion of my land in Crestview, Florida?

If you’re ready to sell a portion of your land in Crestview, Florida, there are a few clear steps to start.

First, assess the land to determine how much you want to sell and its potential value.

This includes checking the size, zoning laws, and unique features that might attract buyers.

Next, consult with professionals to make the process easier—starting with your mortgage lender, especially if you’re wondering, “Can I sell part of my land if I have a mortgage in Crestview, FL?”

Your lender may need to approve the sale, and they can guide you through any necessary steps.

After that, consider working with local experts who know the market, such as Steve Daria and Joleigh.

They are experienced real estate investors and land buyers for cash who can provide valuable insights or even offer to purchase directly.

Preparing the land for sale, like getting proper appraisals and legal advice, will ensure a smooth transaction.

Finally, a plan and timeline for marketing and closing the deal must be created.

For personalized support and a fast cash offer, contact Steve Daria and Joleigh to get started today!

**NOTICE: Please note that the content presented in this post is intended solely for informational and educational purposes. It should not be construed as legal or financial advice or relied upon as a replacement for consultation with a qualified attorney or CPA. For specific guidance on legal or financial matters, readers are encouraged to seek professional assistance from an attorney, CPA, or other appropriate professional regarding the subject matter.