There are many fairly simple ways to Avoid Florida Probate on Your Vacant Land. Navigating the complexities of estate planning in Florida, particularly concerning vacant land ownership, requires strategic foresight and careful consideration. Probate, the legal process of administering a deceased person’s estate, can be time-consuming and costly, potentially delaying the transfer of assets to your intended beneficiaries. However, by implementing proactive measures tailored to avoid probate on your vacant land, you can streamline the inheritance process and protect your assets effectively. So why wouldn’t you want to Avoid Florida Probate on Your Vacant Land?

Costs Of A Florida Probate On Your Vacant Land

Some estimated costs of a Florida Probate on your Vacant Land can be as follows: For estates between $100,000 and $900,000: 3% of the estate’s value. For estates between $1 million and $3 million: 2.5% For estates between $3 million and $5 million: 2% For estates between $5 million and $10 million: 1.5%

The costs associated with probating vacant land in Florida can vary depending on several factors, including the size and complexity of the estate, the value of the land, and any disputes or challenges that arise during the probate process.

Probate expenses typically include court fees, attorney fees, executor fees, appraisal costs, and miscellaneous adminstration expenses, all of which can quickly add up and diminish the value of the estate and your real estate portfolio as a whole.

Court fees in Florida are based on the value of the estate and can range from several hundred to several thousand dollars. Attorney fees are another significant expense, often calculated as a percentage of the estate’s value or billed hourly.

Executors, if not waived their fees in the wills, are entitled to compensation for their time and effort in administering the estate.

Additionally, the cost of appraising the vacant land and any other assets in the estate is necessary to determine their value for probate purposes.

Miscellaneous admininstration expenses, such as filing fees, publication costs, and postage, further contribute to the overall cost of probate.

Moreover, the duration of the probate process in Florida can also impact costs, as prolonged proceedings may incur additional attorney and administrative fees.

Disputes among heirs or creditors can further prolong the process, increasing legal expenses and court costs. Overall, the financial burden of probating vacant land in Florida underscores the importance of exploring alternative estate planning strategies to minimize or avoid probate altogether, preserving the value of the estate for beneficiaries.

So, essentially if you Avoid Florida Probate on Your Vacant Land and do some simple steps, spend a little bit of money, your family can save a lot of money, keep it out of the attorney’s pockets, keep it out of the courts and truly designate who gets what.

Establish Joint Ownership to Sidestep Probate

One effective strategy for bypassing probate on your vacant land in Florida is to establish joint ownership.

By adding another person’s name to the property deed, such as a spouse or family member, you create co-ownership that automatically transfers to the surviving owner(s) upon death, circumventing probate entirely.

Joint tenancy with rights of survivorship and tenancy by the entirety are common forms of joint ownership in Florida that facilitate this seamless property transfer outside of probate.

Utilize Transfer-on-Death (TOD) Deeds for Direct Inheritance

Another efficient method to avoid probate on your vacant land is using Transfer-on-Death (TOD) deeds.

With a TOD deed, you retain complete control and ownership of the property during your lifetime, but upon your death, ownership automatically transfers to the designated beneficiary without the need for probate.

This straightforward mechanism ensures that your vacant land passes directly to your chosen heir, avoiding the complexities and delays associated with probate proceedings.

Establish a Revocable Living Trust for Comprehensive Estate Planning

A revocable living trust offers a versatile solution for avoiding probate in Florida while providing added flexibility and control over your estate.

By transferring ownership of your vacant land into the trust, you maintain full use and management of the property during your lifetime, with designated successor beneficiaries poised to inherit the land upon your death.

Since assets held in a trust are not subject to probate, this strategy can offer significant savings in terms of time, expense, and privacy.

Many will also choose to draft a letter to all parties who are beneficiaries outlining a more personal discussion outside of the trust documentation.

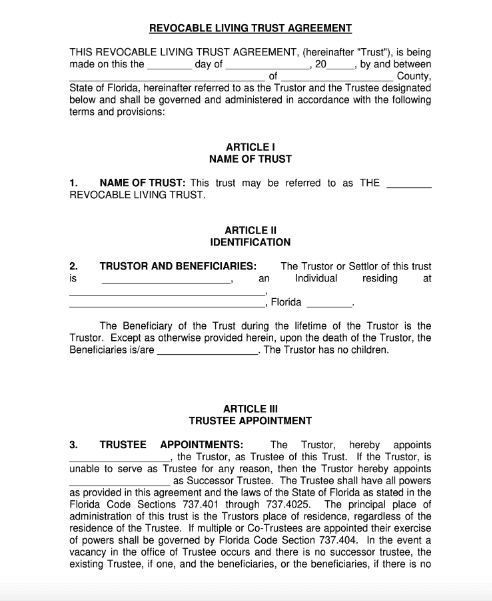

Sample Of A Florida Revocable Living Trust Agreement

The trust document can be extensive but easily prepared by an attorney. Here is a sample of the deck page/affidavit. A complete sample template will be in a downloadable PDF below, complimentary from EFORMS.

Ensure Proper Titling and Beneficiary Designations for Smooth Asset Transfer

Proper titling and beneficiary designations are paramount when aiming to avoid probate for your vacant land in Florida.

Ensuring that the property deed accurately reflects your intentions regarding joint ownership, TOD deeds, or trust ownership is crucial for facilitating smooth asset transfer outside of probate.

Similarly, verifying beneficiary designations on retirement accounts, life insurance policies, and other assets can streamline the distribution process and minimize the risk of probate involvement.

Regularly Review and Update Your Estate Plan for Continued Effectiveness

Estate planning is a dynamic process that requires ongoing review and updates to remain effective, particularly concerning avoiding probate on your vacant land in Florida.

Life changes such as marriage, divorce, births, deaths, and fluctuations in financial circumstances can necessitate revisions to your estate plan to ensure it aligns with your current wishes and objectives.

By regularly reviewing and updating your plan, you can adapt to evolving circumstances and maximize the likelihood to Avoid Florida Probate on Your Vacant Land.

Seek Professional Guidance to Navigate Florida Probate Laws Effectively

Navigating the intricacies of estate planning and probate law in Florida can be challenging, especially regarding vacant land ownership.

Seeking guidance from experienced legal and financial professionals specializing in Florida estate planning can provide invaluable assistance in crafting a comprehensive strategy tailored to your specific needs and goals.

An estate planning attorney can offer personalized advice and solutions for minimizing probate exposure and safeguarding your assets for future generations.

Conclusion: Secure Your Legacy by Avoiding Probate on Your Vacant Land

Owning vacant land in Florida presents unique estate planning considerations, but with strategic foresight and proactive measures, you can effectively Avoid Florida Probate on Your Vacant Land and ensure a smooth transfer of assets to your intended beneficiaries.

By establishing joint ownership, utilizing TOD deeds, creating a revocable living trust, ensuring proper titling and beneficiary designations, regularly reviewing and updating your estate plan, and seeking professional guidance, you can safeguard your legacy and preserve your vacant land for generations to come.

Template Of A Florida Revocable Living Trust Agreement

Do you have real estate in Florida that you are thinking about selling? Let us know below. You can also get the vacant land seller checklist here.